Contents

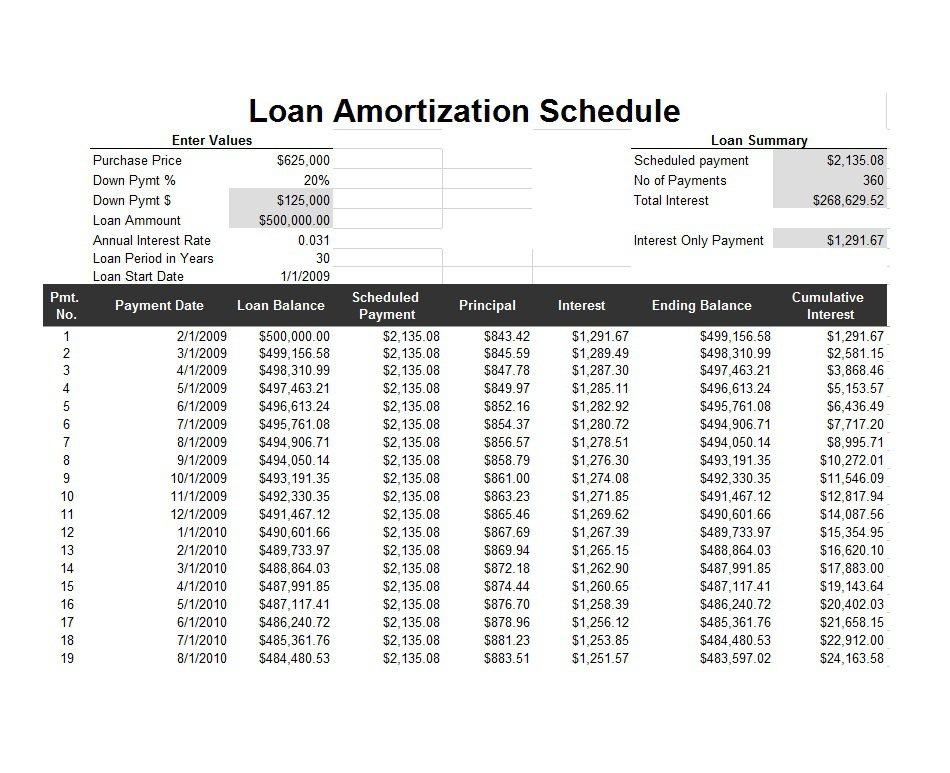

An amortization schedule is a complete table of periodic financial loans, showing the sum of the principal and the sum of the interest comprising each payment until the loan is paid in full at the end of its term. Generating a loan repayment schedule is particularly beneficial if you want to compare two loan options. It can help you break down the cost of the loan into its main components.

Amortization takes into account the total amount you will have when all the interest was calculated and then produces a normal monthly payment. The repayment of the loan shows how much you will pay from month to month. It can allow you to structure your monthly payments accordingly. You can also use the amortization of financing to observe payments from one period to another.

When you refinance financing, either to find a lower interest rate or to change the loan period, you must pay a small fraction of the amount of capital you have left. Taking a loan is a huge commitment. Mortgage loans usually involve large amounts of repayment, since they generally consist of a large amount of money.

Whether you make payments at the beginning or end of the month, create a difference, for example, the amount of interest that is targeted. First, it will decrease your monthly payments. In case you do not meet your monthly payments, the lender has the option of confiscating the vehicle to recover your financial expenses. Although you make exactly the same monthly payment every month, your loan balance does not exactly decrease by the same monthly amount.

Interest comprises a larger part of your monthly payment at the beginning of the loan than at the end. Interest and amortized capital operate in several programs, so they have additional measures to have a balanced loan. Basically, the less main you still owe, the smaller your interest will be.

In the end, the faster you repay your loan, the less you will end up paying interest, so accelerating amortization is an excellent financial strategy. Your loan may have a fixed time frame and a particular interest rate, but that does not mean you are obligated to make the same monthly payment exactly. When you receive a loan from a financial institution or a private financial institution, you must pay interest on the money you borrow.

Enter the month in which the loan will begin. To find the information you need about your loan, you must obtain the original provisions of the financial loan and start from the beginning. At the end of the month, you will notice that your loan has been reduced and that you have saved your money. In a nutshell, since you may be paying the exact amount of this loan every week or month, what you will pay will likely change. If you are looking for a consolidation loan, you can compare it with your current loan to find out if you will receive a better deal.

monthly amortization schedule printable

amortization calculator schedule Demire.agdiffusion.com

monthly amortization schedule printable

Similar Posts:

- Printable Amortization Schedules

- Printable Mortgage Amortization Calculator

- Printable Ancestry Sheets

- Calculator Printable

- Printable Receipts For Rent

- Free Printable Budgeting Worksheets

- Printable Monthly Bill Tracker

- Printable Monthly Bill Chart

- Printable Personal Financial Statement Form

- Printable Monthly Schedules

- Budget Printable Sheets

- Texas Vehicle Bill Of Sale Printable

- Loan Officer Job Description, duties and FAQ template

- Budget Ledger Printable

- Monthly Budget Printable Worksheet

- Easy Budget Template Printable

- Free Printable Weekly Budget Planner

- Free Budget Planner Template

- Monthly Schedule Printable

- Printable Monthly Expense Tracker

- Printable Payment Log

- Printable Budget Planner Free

- Printable Monthly Budget Worksheet Excel

- Printable Paycheck Template

- Bookkeeper Job Description: Requirements And Skills To Have As A Bookkeeper

- Automobile Bill Of Sale Form Free Printable

- Printable Budget Sheets Monthly

- Free Printable Monthly Business Expense Sheet

- Free Printable Bi Weekly Time Sheets

- Printable Contract For Selling A Used Car